The end is inevitable, Maverick. Your kind is headed for extinction.

Maybe so Sir. But not today.

While everyone is busy having imagination of their inevitable extinction in bear market, let’s review back to what it was. In December article, we believed that Nasdaq was going down hill and their indirect consequence, inflation would be triggered. Eventually, it has been going down hill quite remarkably. When liquidity tide is gone, expensive premium is surely getting normalized. Nasdaq has been notoriously running very expensive for decades with average PER (Price Earning Ratio) astonishingly above 100. To make it worst, its capitalisation, 20T$, is about half of the entire US industrial share market (40T$) or about global listing. Yet human life spending is not half to technology if we are willing to step outside. There are way more than half of the earth population are still fighting their life with centuries old of economy practice and not just to technology and capital growth. Look no further to SME (Small Medium Enterprise) or sustainable human economy practice resiliency, when their high life society run is being revolted.

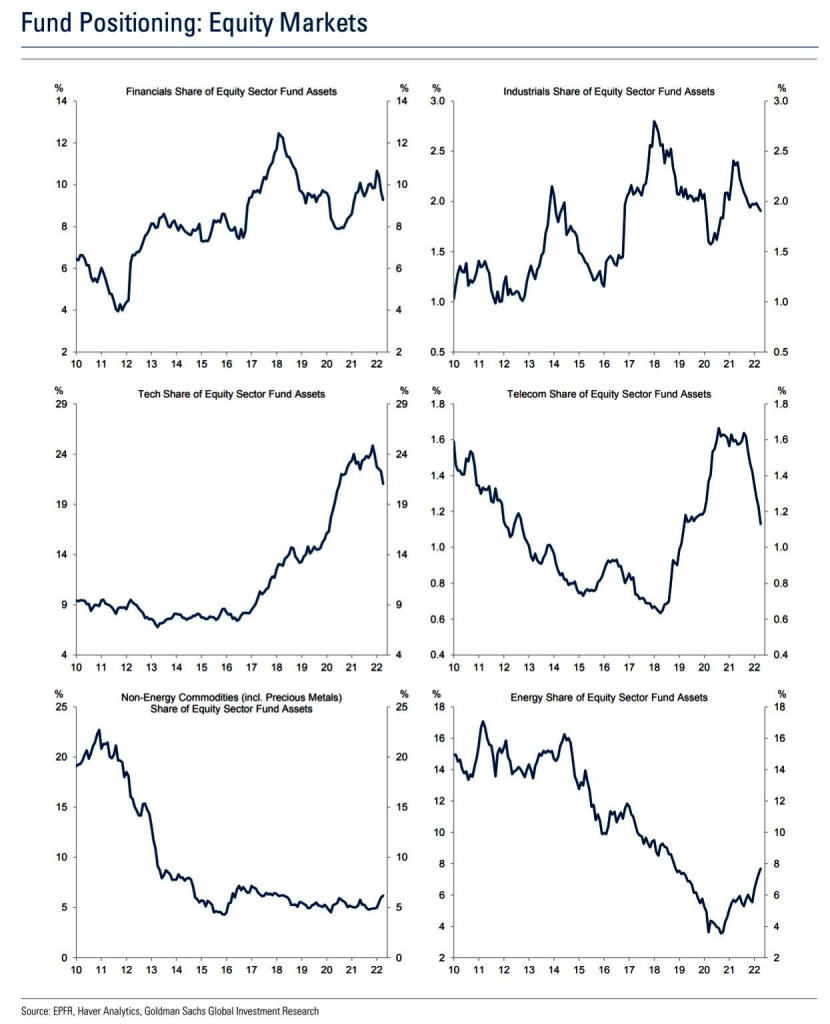

When those expensive technology funds are being normalized in higher society, there should be a lot of money being juiced, spiking high energy and inflation as we expected since our December article.

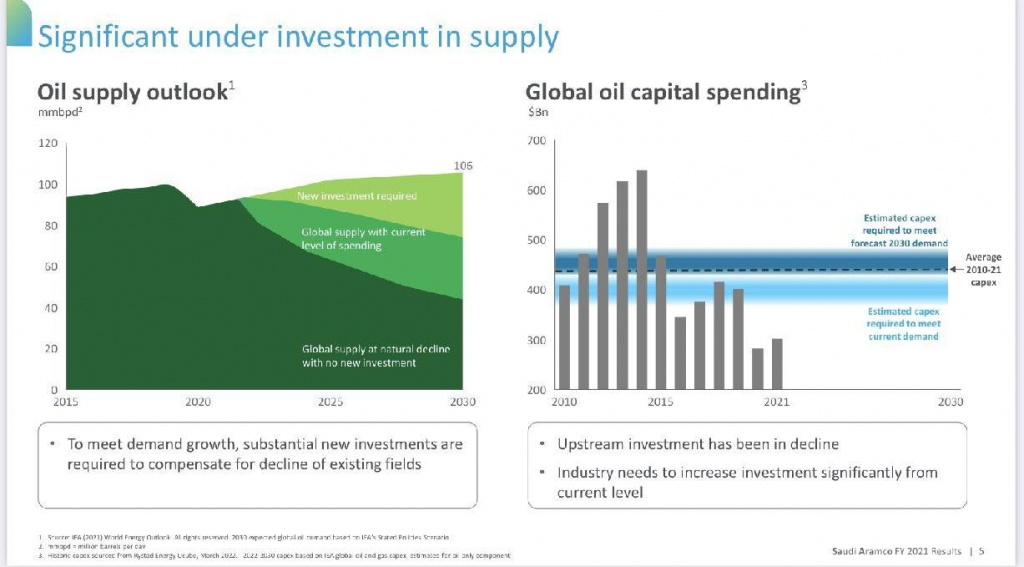

Do we think this energy maverick graph/move is expensive already? Oh come on. Tesla, just by itself, in only 2 years of their move, is already equal to about half of all USA energy market, let alone many decades running gigantic technology companies, like the FAANG. It doesn’t make sense to hold USA technology dependence funds without thinking about enormous amount of “Energy” and Commodity fund being juiced up. These energy and commodity capitalisation is still remarkably very small compared to overall US financial market. Why does the Fed even think about massive tightening IF inflation (in which most of them are driven by energy and commodity) is not a real threat in near future? The Fed might even think, Nasdaq still has some room to continue their downhill to support this narrative.

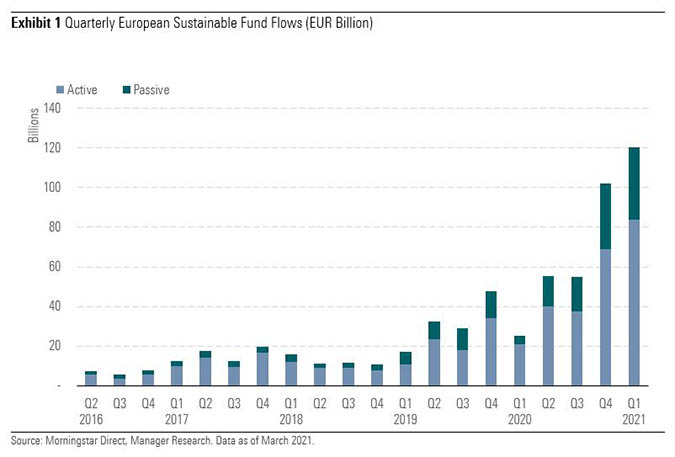

In previous month article, I promised to start looking into ESG (Environmental, Social, and Governance) issue in H2 2022. In near future, in my argument, I believe the ESG could be one of future solution to our high inflation negativity. Before getting into this argument, I may give some background about the ESG. The ESG funds had been running super fast past few years or in simple word, they are expensive and there’s not yet enough growing room/capacity to capture them. Abundant amount of liquidity due to years of QEs (Quantitative Easing), has given enormous amount of excess fund to go after futuristic ESG, trying to replace centuries old fossil fuel. Since December 2021, when market started to realize abundant liquidity is to slow down, expensive and overrun ESG funds are getting normalized as well. One of their significant impact was in battery industry which were too crowded with the funds, e.g. Lithium, Nickel, etc. Since there are too much investment supply but not enough economy demand, this leads to many ESG dirty secret/frauds. Some of ESG funds are not actually invested in ESG, but they are just directed to any normal fund, fraud to their disclosure, and helping bubble to many non ESG assets. There are few raids and whistle-blower stories already.

On the other hand, fossil fuel, which is still fuelling almost all of the earth population are still under investment. The rush to futuristic ESG itself may unfortunately reduce/prohibit investment to fossil fuel to meet real demands.

We believe that Energy, our top pick since 2020 is still one of our favourites. We still avoid precious metals since 2020 because they don’t really offer value into inflation and economy growth cycle. Indeed since year 2020, we might believe there could be an issue with the precious metals at the end of this high inflation cycle. We will continue to hold energy and commodity sectors strong.

Yet you refuse to die. You should be at least 2 star admiral by now. Yet here you are. Captain. Why is that?

It’s one of life’s mysteries, Sir.

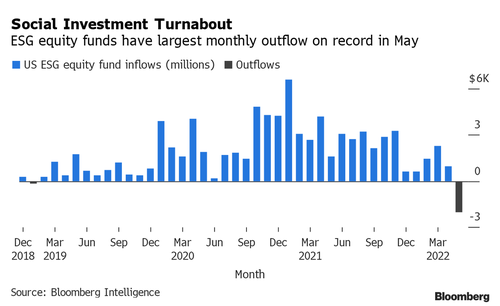

So, why do we need to bring ESG issue from H2 2022? After being normalized since December 2021, there are many ESG funds experiencing massive outflow. Indeed in May 2022, ESG started to experience first huge outflow.

Overpriced lithium and nickel for example, have been driving EV cost beyond their competitive value to non EV. It comes to the main question. Should they be over or are they going into normalization process. We do believe they will go through normalization. At what level? We think, it might be easier to measure with inflation, mainly in energy. Once energy price is fair enough and those expensive prices are normalized down, they should meet an equilibrium. This article may explain well the situation of ESG and non ESG.

We believe, during the Fed normalization, we would need to come down to earth. We may hold our top picks, food, energy, and commodity, while we normalize our EV and EV commodity. We are still considering EV sector better than oldies and being obsolete technology which may already get stuck in their innovation. Market is expecting need of faster pace of technology innovation but they may already stall. An ironic example is The iPhone’s lock screen is getting its “biggest update ever” so you can customize the colors and design of your screen.

Since we are focusing on real economy, we feel the need, the need for speed. Look no further to China and emerging, they are about to reach their due for speed once inflation momentum threat is about to plateau. Their growth has been stalling and they need the speed. We will highly focus our investment on their speed needs. To drive their growth, they obviously need massive amount of energy and commodity, things that emerging have been very sensitive and lack to generate internally.

To compete with China and emerging, we believe that advanced market should also focus on real ESG. Advanced countries should still have strong power in financial. While recently many disagree with lower USD, they should at certain point use the currency and lower rate weapon to drive their critical but still profitable companies. We therefore follow company with strong ability to tap cheap fund like the ESG fund to combat interest cost during high inflation. If we may suspect, they may use cheaper ESG to fund merger and acquisition, when their competitors are having issue with expensive cost.

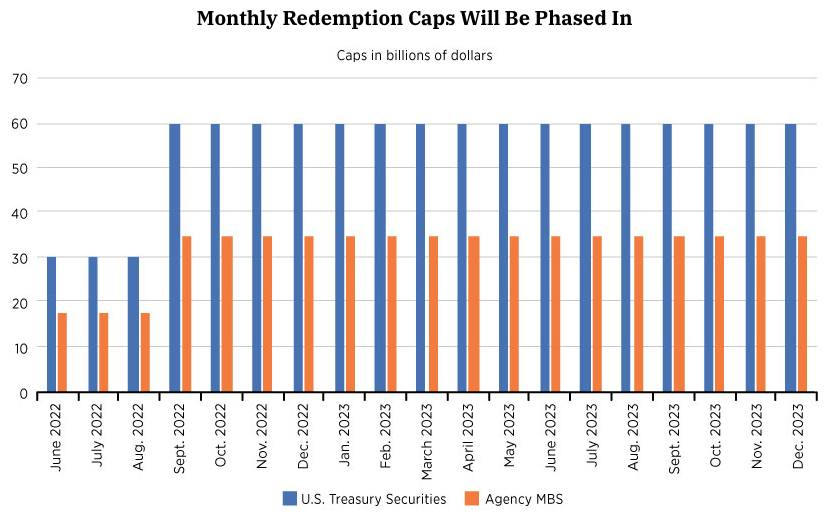

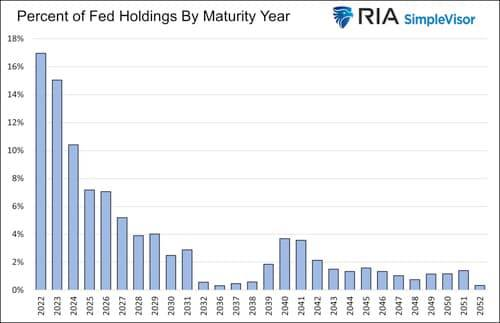

This high interest might be indirectly related to the Fed balance run-off theme. Every month the Fed receives about 128B$ from their maturity. Since there’s about 30B$ QT (Quantitative Tightening) cap, the Fed is actually still re-investing about 98B$ every month. These run-off should be fairly funded enough with existing 2T$ of RRP if we balance their number.

We do think, it’s enough to run until about end of 2023, in which we should then see lower inflation by next year. I may think there is a possibility of commodity and energy mergers and acquisitions during the time.

This situation may be well supported with YCC (Yield Curve Control) to ensure banking systems are still functioning when the Fed is raising their front end rate. At same time, the 30B$ in which the market has to consume, should be sold at discounted price. Our these two arguments, should support our expectation that long yield may continue to increase and indirectly maintain sustainable high inflation thesis.

Any idea in this blog and website are my personal own. They are not financial advise.

10$ lettuce.

While many smeared inevitable extinction with their bear thesis and China tries not to ignite more fire, we are happy to wait for them to go maverick.

USDJPY seems to show off first when US senate disagreed with pursuing lower currency. USDEUR and USDGBP ? If that’s happening, it might support capitulation thesis rather than selling thesis. Portfolio to inevitably extinct? May be so Sir, but not today!

Four years ago correlation might be happening. USDJPY and OIL is positively correlated when inflation expectation and rate are both raising (which are currently happening) and negatively correlated when US is pursuing weaker USD currency (which doesn’t seem yet to let to happen). https://www.uk.daiwacm.com/media/142345/10may18fmw.pdf

It’s probably the time to start taking out some of energy of the table. Their run was too fast recently.

It seems to be in reverse.